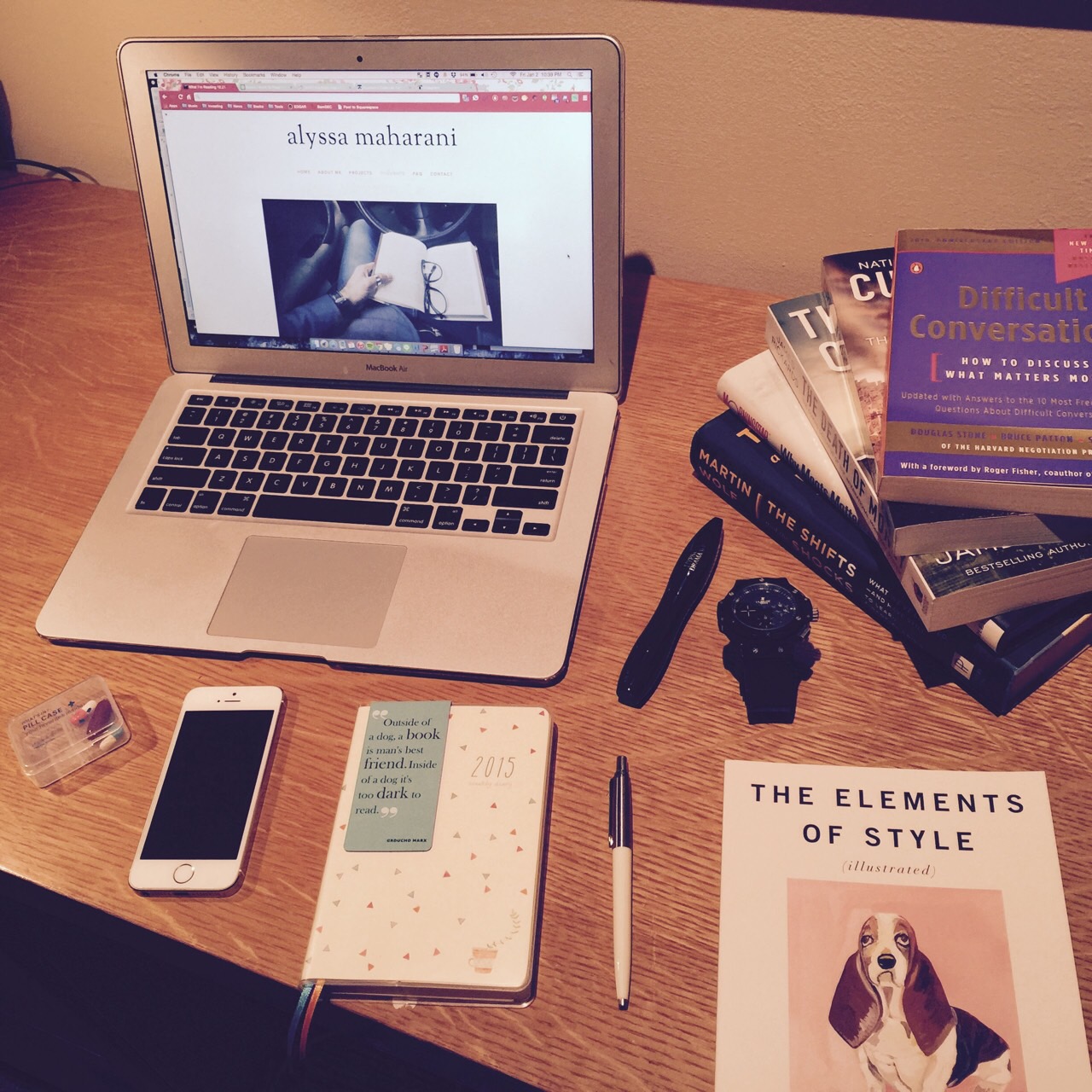

What I'm Reading 03.23.15

1. Emily Nussbaum on The New Yorker "Candy Girl"

In case, people don't know, I love TV comedies (a problem caused by severe insomnia). I just finished watching an entire season of Unbreakable Kimmy Schimdt, a Netflix show that recounts a girl who navigates New York City after being kidnapped for 15 years by a doomsday cult. Kimmy's optimism is so effervescent, and this piece perhaps capture what I believe is the essence of the series. We are more than our worst days, in fact surviving is more than just existing - it is a freedom within ourselves.

2. Aswath Damodaran on Musings on Markets "Illiquidity and Bubbles in Private Share Markets: Testing Mark Cuban's thesis!"

The valuation guru has spoken! This time, he talks about the tech bubble, specifically the one that Mark Cuban (Shark Tank dude) believes come from the private market due to the absence of liquidity. I think Damodaran is completely spot on with regards to the private market taking a discount of liquidity. Just think about PEs and VCs all aiming to get IPOs. Why in the world would they do it, if they do not believe in the value of liquidity premium? In fact, the private market limits the impact of the bubble, by limiting the effect to only institutional players. We would be protecting many of the passive and/or retail investors. Props to the valuation guru for using good data to come to this conclusion.

3. Seth Mydans on New York Times "Lee Kuan Yew, Founding Father and First Premier of Singapore, Dies at 91"

Through my interactions with many Singaporeans, I have learned to garner respect for the founding father of Singapore. I am still amazed by how much of an improvement he brought to Singapore: the political stability, the economic development, the human capital investment, and the social security structure. I won't say his reign was perfect; at times, he could be authoritarian especially with regards to gay rights and freedom of press. But indeed, the efficient, developed Singapore of today only existed due to his founding contributions, and for that, I think it is high time we pay our respects.

On another note, Kygo and Ke$ha is headlining this year's Spring Fling (which is Penn's big annual concert tradition - we had Tiesto & David Guetta last time - YEAH, BE JELLY PEOPLE). So yeah, here's my favorite song by Kygo to celebrate: